Rather than waiting weeks to hear back from a traditional bank, businesses could secure the cash they needed in as little as 24 hours.

also made invoice factoring more accessible. Technological breakthroughs, like Internet access, cloud-based platforms, etc.

Moving into the 2000s, smaller factoring companies began to emerge that targeted the needs of specific industries. By the 1990s, major banks like GE Capital and GMAC began incorporating factoring into their services. Unlike traditional financing options, invoice factoring did not involve the same credit checks, and it allowed business owners to avoid similar interest charges. Fast forward to the 1960s and 1970s, rising interest rates and bank regulations made invoice factoring an increasingly popular solution. banks were beginning to provide companies with factoring services. It wasn’t until after World War II that invoice factoring began to expand to other business types and industries in the U.S. used invoice factoring to ensure they could continue to purchase raw materials. Modern Factoring in the 1900sĪt the start of the 1900s, garment and textile companies in the U.S. Once the goods had arrived at their destination, a percentage was withheld for the sale and the money owed was collected. Whether the goods were being shipped to the colonists or back to England, the factor would pay a discounted rate to the seller before the voyage. Due to the distance and time, it took for settlers to obtain their materials from England and then ship their goods (cotton, timber, tobacco, fur, etc.) back, merchant bankers in London found it was necessary to advance funds to colonists for the materials they needed – or face bankruptcy. Both the East India Company and The Hudson Bay Trading Company used invoice factoring, as the British Empire sought to colonize the New World. Moving the focus further north, factoring was also beginning to be used by clothing merchants in England.īy the time English colonists began making their way across the Atlantic to America, invoice factoring had become a common business practice. As this service grew, the merchant bankers began advancing money against the delivery and payment of grain shipped abroad. Essentially, these early merchant bankers offered high-risk loans to the farmers against the crops in their fields. Prevented from holding ownership of land in Italy, but allowed to engage in local commerce in grain crops, they began charging a fee for the use of cash. During the 1300s and into the 1400s, Jews fled to Italy to escape the persecution taking place in Spain. Events that took place across Europe called for this form of financing for different types of merchants. The modern form of invoice factoring began to take shape during the 1300s. Known for utilizing and improving upon inventions and concepts, the Romans were the first to sell discounted promissory notes at discounted prices and to conscript collectors to settle their trade debts. Some form of factoring was used by each civilization that followed, including the Romans. Even though the Mesopotamian civilization later became extinct, factoring survived.

#Factoring invoices advancements code

This well-preserved Babylonian law code of ancient Mesopotamia dates back to around 1754 B.C. The factoring rules of the ancient Mesopotamian culture were laid out in the Code of Hammurabi. In ancient Mesopotamia (what is now modern-day Iraq, Kuwait, and Syria), a form of factoring was first used in traders’ business dealings. From medieval businessmen and English colonists to the modern services we see today, invoice factoring has an extensive history. One of the oldest forms of business financing, the history of invoice factoring goes back 4,000 years to Mesopotamia. The need for a business to be able to raise funds has existed as long as trade and commerce have. The business is leveraging its unpaid invoices to generate cash on hand.īelieve it or not, invoice factoring is not a new concept.

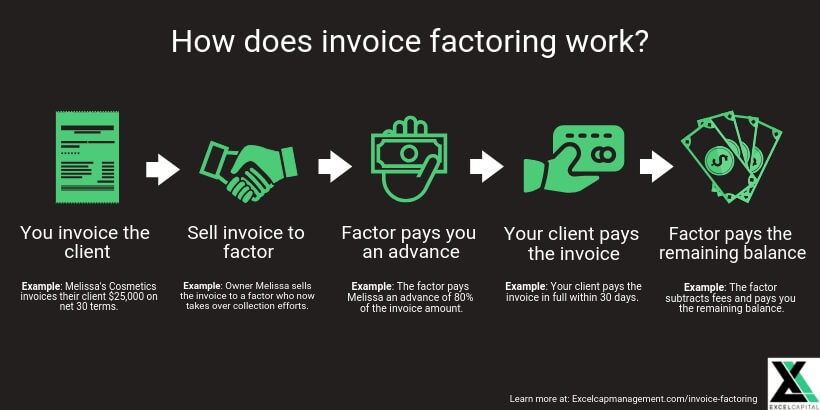

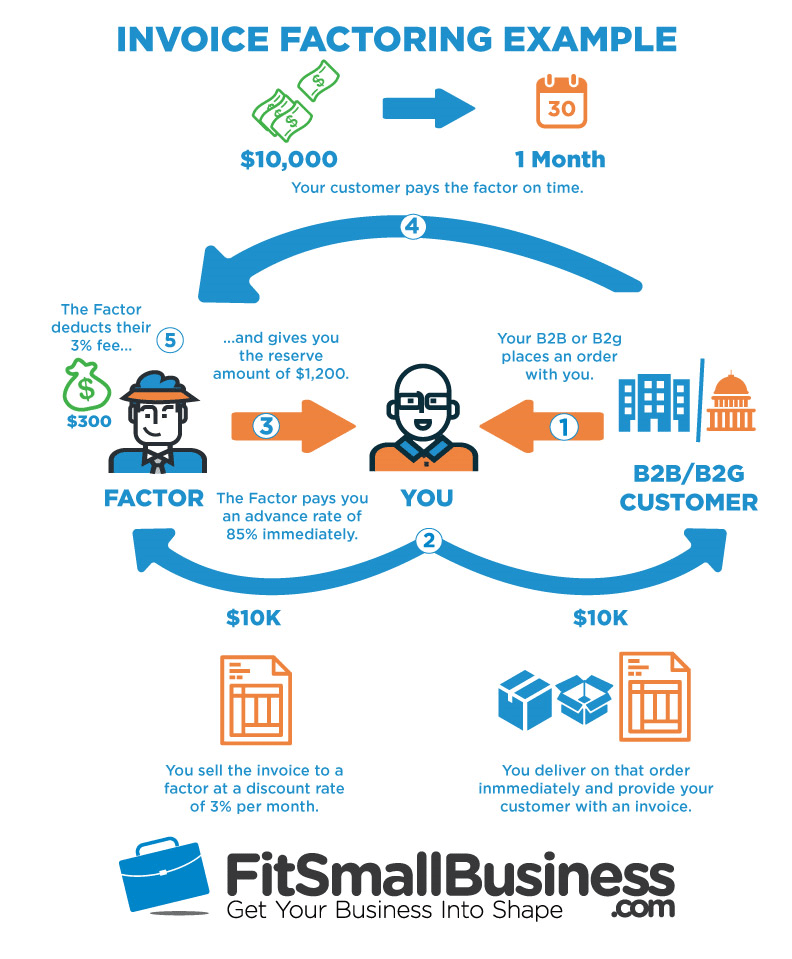

Invoice factoring involves a factoring company purchasing a business’ invoices, and then quickly advancing working capital to the business against its unpaid accounts receivable. As a result, many entrepreneurs have turned to alternative financing solutions, like invoice factoring. According to The Wall Street Journal, this is due to the weak demand, high costs, and tighter lending standards that followed the 2008 economic crisis. Over the past few years, banks have considerably reduced the number of loans they issue to small businesses.

0 kommentar(er)

0 kommentar(er)